OUR BLOG

The Four Pillars Of A Dignified Job

Jobs that go beyond income to provide safety, stability, inclusivity, and meaningful rewards are crucial for people in poverty to earn a dignified living.

The Importance Of Being A Smart Philanthropist: Leveraging Venture Philanthropy And The Indian Diaspora's Giving Potential

By investing in social enterprises and focusing on measurable outcomes, we are able to demonstrate the principles of venture philanthropy and smart giving. Intertwining India's entrepreneurial energy with the passion of philanthropists creates a powerful force for change, where innovation meets compassion to drive sustainable social impact.

Data Dashboards: Visualizing Impact Data For Improved Learning

We’re starting this year by launching Upaya’s revamped dashboards in line with its refreshed branding. Data visualization improves data comprehension, insights generation and helps in communicating complex patterns and concepts. Our aim is to advance the way we comprehend the impact data that is collected continuously from job holders and our enterprise partners to make it more helpful for usage in decision making and communicating our impact.

A Dignified Job Is At The Heart Of Climate Justice

The impact of climate disasters and environmental degradation mainly affecting vulnerable communities infers that climate change and poverty are interlinked. It removes them from their home, forces them to migrate to cities, and even pick up low quality jobs to sustain themselves and their families.

The Dignified Jobs Collaborative: To make An Impact, Not Just Any Job Will Do

Upaya’s work of supporting social entrepreneurs as they create dignified jobs for people in extreme poverty is part of a much broader conversation about the dignity of work.

The Many Faces Of Dignified Jobholders

A big part of Upaya’s mission is expanding the conversation about job quality to intentionally include jobs created for those living in extreme poverty in emerging markets. But even within that subgroup, there are important variations that we need to understand in order to measure impact.

Patiently Coming Full Circle

Upaya added to our initial support for this company, Tamul Plates, and joined with another like minded investor, Artha Impact, the impact investing arm of Rianta Capital Zurich, to place an equity stake in it. At the time, our $27K was a big investment for Upaya.

How We Measure What Matters: A Framework For Measuring Job Quality

As a mission-driven fund, Upaya Social Ventures aims to create dignified jobs for the poorest of the poor by supporting early-stage entrepreneurs anchored in marginalized communities.

How can technology innovations sustainably solve the global food challenge?

With scientific advances post World War II, many defense technologies found applications in agriculture. This innovation drove food production and productivity thus reducing starvation deaths globally. The same technologies left a huge imprint on the planet’s soil, water, and biodiversity. Now, we need to focus on both enhancing food production for the growing population while also producing it in a sustainable manner.

How Digital Connectivity Opens Doors For Rural Poor To Lift Themselves Out Of Extreme Poverty

India is a country with extreme inequality in income. The top 10% earns an average income of over 20 times more than the bottom 50%. In the absence of a quality public education and healthcare system, the majority of the poor find it difficult to break out of generational poverty

How Our Accelerator Program Continues To Evolve To Best Serve Early-Stage Entrepreneurs

Upaya’s annual accelerator program is a key component of our mission to support early-stage social enterprises.

Giving Money Back To Donors

Upaya has done something novel in the past few weeks – novel for us, at least – we’ve written checks to our donors… and it feels great.

This Mother’s Day We Wish For Dignified Jobs For All Mothers At Work

This Mother’s Day, as two working mothers at Upaya, we reflected on what it would take to create dignified jobs for mothers from extremely poor households. Despite their hardships, these women have the strength and ability to address the difficult battle of being a worker, a woman, and a mother, but they can’t do it alone

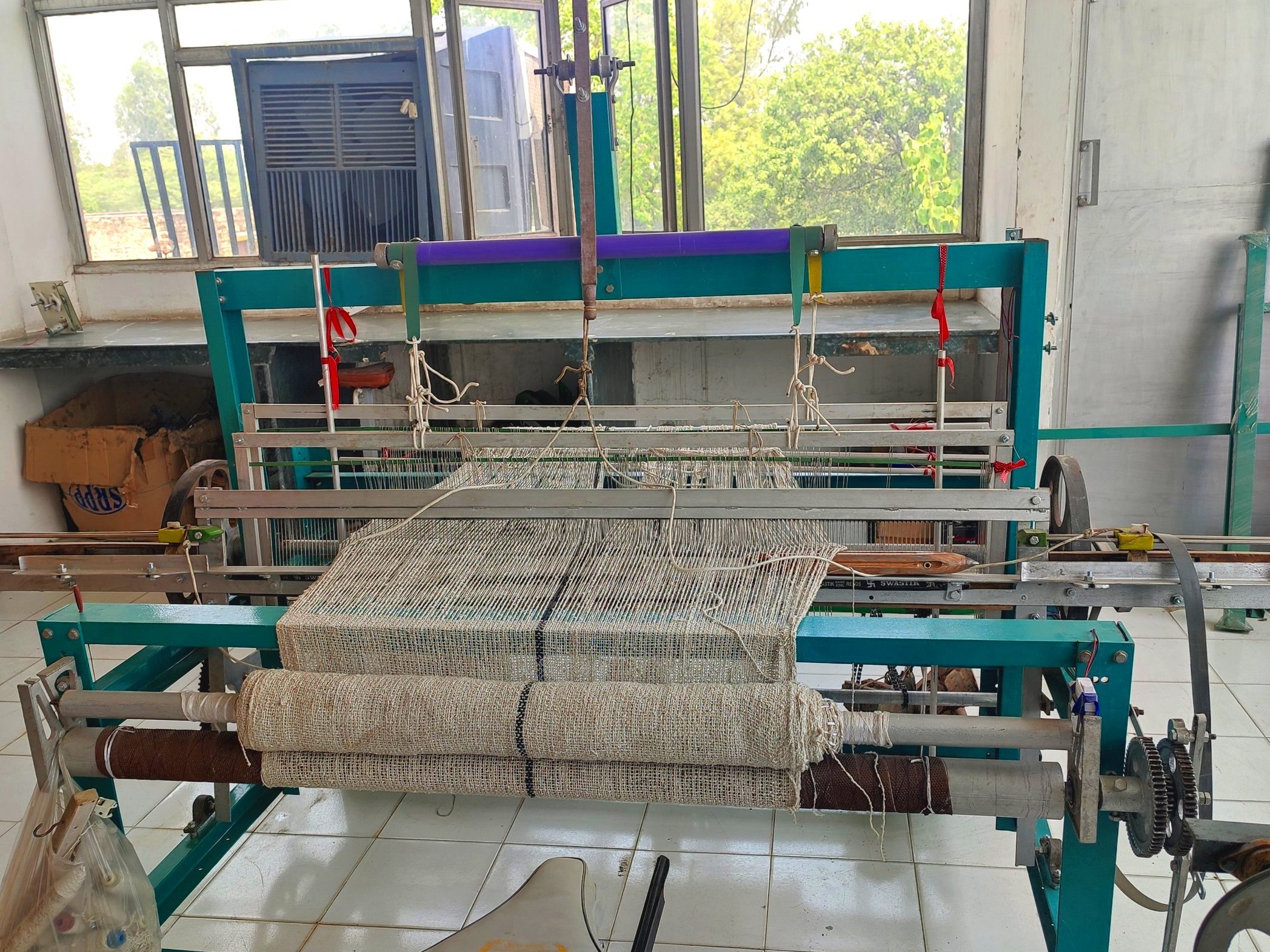

How Resham Sutra Is Weaving Its Theory Of Change To Empower Rural Artisans

Upaya’s portfolio company Resham Sutra embarked on their journey to create a Theory of Change Framework recently.

How Dignified Jobs Build Resilience For The Extreme Poor

Globally, research has shown that the extreme poor are greatly affected by the cause and effects of climate change. Air, water, and other sources of pollution are often the causes of climate change while extreme weather events such as heatwaves, drought, floods and hurricanes are the effects – both of which wreak havoc in the lives of the poor, often posing a threat to their livelihoods, health, and infrastructure. The poor are especially vulnerable as they lack coping mechanisms which are neither accessible nor affordable.